The new proposal for Seed Marketing in the EU was presented by the Commission on July 5th. In 2013, a first attempt to revise this intricate legislation did not succeed in gaining parliamentary approval. So, what does the new proposal entail? And can we expect a different outcome this time around? Overview and initial analysis of the Commission’s seed marketing reform proposal by the Seeds4All project.

In this article, we aim to provide a brief overview of some of the key proposed changes to the EU’s Seed Marketing legislation. To achieve this, we will share insights from the webinar organised by Arche Noah on July 10th, where Fulya Batur from Kybele led the presentation. The presentation covered a wide range of topics, and the elements we present here are only a small selection.

Structure and scope of the EU seed marketing framework

The current seed marketing legislation is composed of 12 directives, 3 derogation regimes and 1 regulation on organic production. The origins of the Commission’s reform proposal lie first and foremost in the desire to simplify this structure and harmonise the common EU seed market rules.

The reform proposal tabled on July 5th is based on three acts: one directive for ornamentals; one Regulation for forest Plant Reproductive Material (PRM); and one single Regulation for all the other types of cultivated plants, including organic production. In this article, we focus on the latter.

Similarly, to the current framework, only regulated species (listed in the annexes) are concerned by the legal framework soon to be debated. But the big innovation is the flexibility given to certain players to operate outside the scope of the legislation.

The Regulation proposes a new definition of marketing including only the actions of professional operators. Four different actor types are considered not to act as professional operators. Consequently, they will not need to go through operator registration and are considered to fall outside the scope of the Regulation, although various requirements will remain.

Specific regimes for specific seed actors

In the table below, we synthesise the rules for these different actor types.

| Actor type | Definition from the Regulation | Rules |

| Professional operator | ‘professional operator’ means any natural or legal person, involved professionally in one or more of the following activities in the Union concerning PRM: (a) production; (b) marketing; (c) maintenance of varieties; (d) provision of services for identity and quality; (e) preservation, storage, drying, processing, treating, packaging, sealing, labelling, sampling or testing; |

|

| Private Person / Final Users | ‘final user’ means any person acquiring, transferring and using PRM for purposes which are outside that person’s professional activities (e.g. individual seed savers / gardeners) |

|

| Gene Banks / Networks | Gene banks, organisations and networks with a statutory objective, or an official objective notified to the competent authority, to conserve plant genetic resources, whereby any of the activities are carried out for non-profit purposes. |

|

| Breeders | Not provided |

|

| Farmers | ‘farmer’ means farmer as defined in Article 3(1) of Regulation (EU) 2021/2115 (CAP Strategic Plans) |

|

Table 1: Specific regimes for specific seed actors

(Source: Regulation proposal & Arche Noah’s webinar)

Market Access: quick overview

Main route

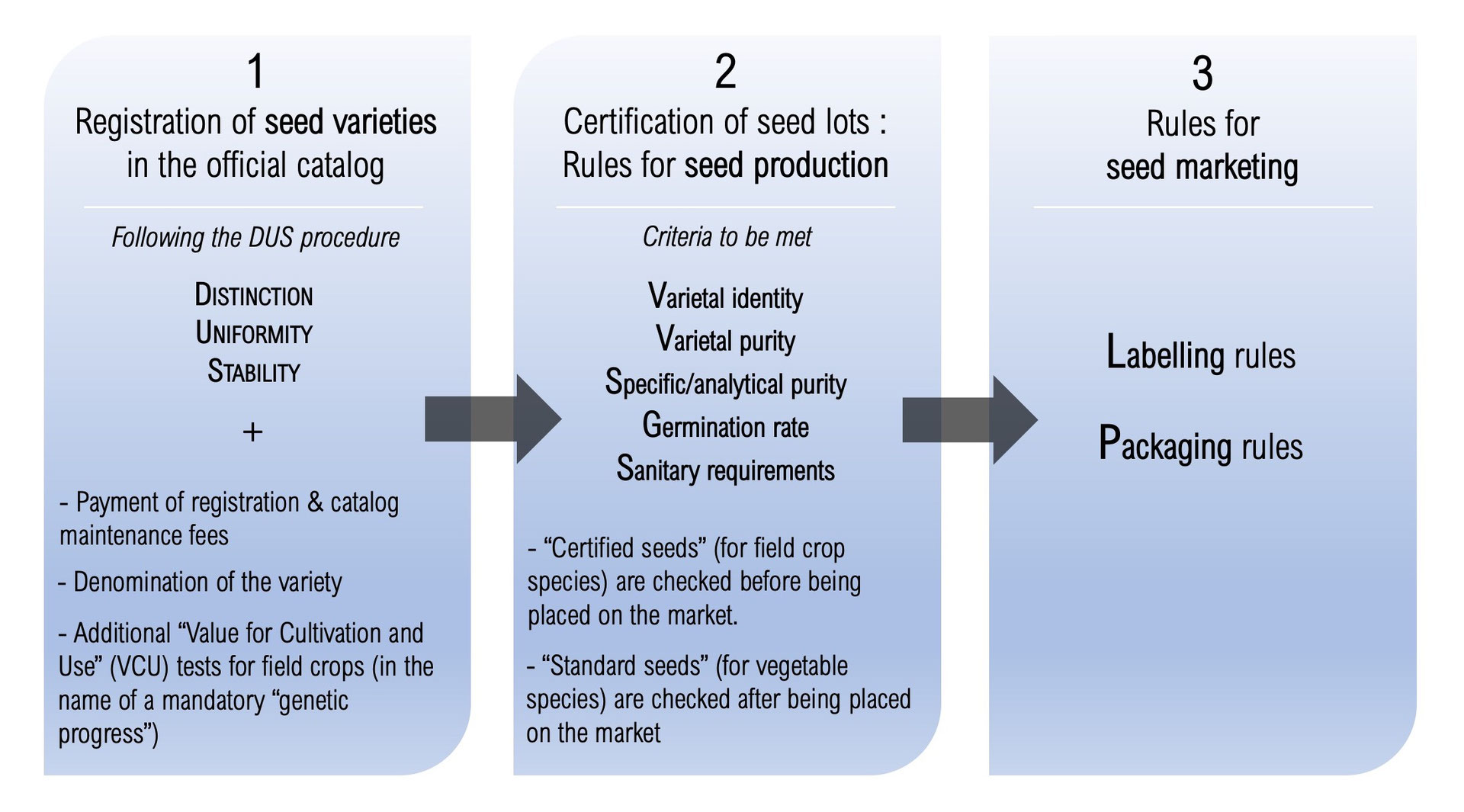

The access to the market will still be based on the same three pillars – pre-marketing registration (operator registration & variety registration); quality seed production (quality criteria & seed lot certification); labelling and packaging – but some adaptations are being proposed by the Commission.

Below is a non-exhaustive list of key information we have chosen to highlight. Careful to note that these rules can vary for specific PRM such as rootstocks and clones. For a closer look at all the changes proposed by the Commission, you can access the full text here.

Seed Marketing main route key information

|

Main Route |

Variety registration |

|

|

Registers |

|

|

|

Seed production |

|

Table 2: Seed Marketing main route key informations

(Source: Regulation proposal & Arche Noah’s webinar)

Derogation routes

The proposal introduces three schemes to allow derogations from the main route, under certain conditions.

The first one concerns conservation varieties, which includes all current amateur varieties, which can be either traditionally grown or newly bred locally. However, they must possess a high level of genetic and phenotypic diversity, which could be limiting.

The second one concerns heterogeneous material. The objective is to integrate the rules from the EU Regulation on organic production adopted in 2018 and which authorised a special framework for marketing so-called organic heterogeneous material. For that category, maximum quantities are imposed.

The third one concerns the sale to final users (see definition above), and is the lightest. No variety registration or seed certification is needed but the seller needs to be registered as an operator. For that regime, only small packages can be sold.

Many specific rules apply to each regime and can be found in the proposal.

Are we gearing towards a 2014 scenario?

Stepping back from the proposed reform specificities, it is worth asking whether the Commission has considered the reasons for the 2014 failure and how today’s context may impact the negotiation process.

In 2014, the rejection of the proposal tabled in 2013 was based on three main arguments. First, it was deemed insufficient in promoting biodiversity conservation. Secondly, the “one size fits all” approach did not meet the diverse needs of operators, consumers, and public authorities. Lastly, concerns were raised regarding the delegation of excessive powers to the Commission, making it challenging to assess the Regulation’s impact.

The most notable improvement in the current proposal is the recognition of the diversity of operators’ profiles and needs. While the main route for marketing seeds remains centred on the DUS and UPOV systems, many players would have the opportunity to sell and exchange seeds outside the strict legislation.

But the devil lies in details, and the exemptions provided for operators such as gene banks, amateur gardeners or farmers will need to be better evaluated before any conclusions can be drawn.

It is also important to mention that, although the proposed derogations look promising, the scale for moving from the main regime to a derogation one is high. Many professional seed operators might find themselves as too big for derogations but too small for officially registering varieties in catalogues. Moreover, certain derogation regimes such as the one for farmers, are very restrictive.

From our point of view, four red flags could make the road to approval harder.

The first tricky aspect is the connection between the proposal to reform the legislation on seed marketing and the proposal to deregulate so-called new GMOs (NGMOs). The seed marketing reform proposal already incorporates NGMOs in its register listing. In addition, the introduction of the VSCU criteria, offering the possibility to address environmental issues, runs the risk of providing an entry point for GMOs, which are now commonly presented as a solution to the erosion of cultivated biodiversity and the need to adapt genetic resources to climate change.

Another issue pertains to patents. If NGMOs are allowed to be marketed, it is likely to result in a surge of patented varieties drastically limiting farmers’ seed autonomy. Not to mention that the Commission proposal does not guarantee that information regarding patents will be included in the registers.

On patents, the Commission released an official communication on July 5th as well, stating that it “will assess, as part of a broader market analysis, the impact that the patenting of plants and related licensing and transparency practices may have on innovation in plant breeding, on breeders’ access to genetic material and techniques and on availability of seeds to farmers as well as the overall competitiveness of the EU biotech industry”.

But the report on the findings of this analysis can only be expected by 2026, which doesn’t fit the timeline of the debates to come and approval procedure of the two files.

Third redflag, the proposal involves delegating a significant amount of power to the Commission, which was one of the primary reasons why the Parliament rejected a similar proposal in 2014. The figure below shows the list of powers that the Commission will have through delegated and implementing acts. This margin of power is expected to cause dissatisfaction among Member States, who increasingly advocate for national adaptations of EU regulations, as seen in the case of the Common Agricultural Policy.

Fourth, the proposal comes with significant additional administrative burden for Member States and professional operators.

Only time will tell what will happen to this proposal. There is still a long way to go. The next step will be an 8-week period to react to the proposal. Then the EU Parliament and Council will begin their own process of assessing and amending the text until the trilogue can begin.

Until then, let’s make sure that the issues of cultivated biodiversity, seed autonomy and food sovereignty influence the debates right up to the European elections in 2024.

More

Adapting Agricultural Practices to Climate Change – Seeds, Beans and Lessons from the Ground Up

EU Seed Law Reform and New Genetic Engineering – Double Attack on our Seeds

Irish Tour part 1 – Agrobiodiversity as a Key Driver for Rural Revolution